| Having trouble viewing this email? Click here |

|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

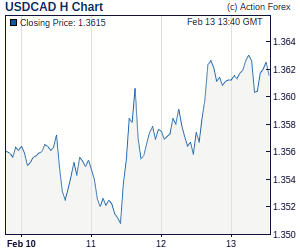

Daily Report: Dollar Firm as Sentiments Still Pressured by China Tightening Fear and Ireland UncertaintyDollar remains generally firm today as Asian equities are weighed down by fear of more tightening from China as Premier Wen Jiabao said the government is drafting measures to curb excessive price gains. Meanwhile, Central Bank Governor Zhou said China is under 'pressure' from capital inflows, signaling the government may act sooner rather than later to counter inflation. More upside is still in favor in the greenback is general but Technically, it should be noted that financial markets are entering into important levels soon. Firstly, dollar index will be facing key structural resistance level at 80.08. Gold would be facing 1315 key support while crude oil will test 80 psychological level. DOW will also face key support level between 10720 and 10958 55 days EMA. We'll be alerted to any sign of near term reversal in the greenback. | |

| Featured Technical Report | |

USD/CHF Daily OutlookDaily Pivots: (S1) 0.9865; (P) 0.9921; (R1) 1.0014; More. USD/CHF's rise from 0.9547 extended further to as high as 0.9974 so far and the break of 0.9970 invalidated our view. Instead, it suggests that whole rebound from 0.9462 is still in progress. Intraday bias remains on the upside and further rise should be seen to 100% projection of 0.9462 to 0.9970 from 0.9547 at 1.0055 next. Break will target 1.0330 key cluster resistance then. On the downside, below 0.9829 minor support will turn intraday bias neutral again. But break of 0.9547 is needed to signal that fall from 1.1729 has resumed. Otherwise, we'll stay neutral first. |

| Forex Brokers | ||||||

|

| Special Reports |

RBA Unlikely Hikes Rates In The Near-TermThe RBA released the November minutes, citing the surprising rate hike of +25 bps was a forward-looking decision and macroeconomic developments suggested tightening was warranted. Policymakers considered rate hike was finely balanced. We believe it's unlikely for the central bank to tighten again in the near-term. Indeed, the minutes provided no hints that further adjustment was considered although 'the medium-term economic outlook remained one of strengthening economic activity and gradually rising inflation'. Will Ireland Eventually Seek Bailout?Sovereign crisis in peripheral European economies is again under the spotlight as the hottest discussion over the weekend was whether Ireland will request a bailout from the EU. Yield spreads between periphery bonds and German bunds narrowed last Friday after rumors saying Ireland may tap funds from the EU/IMF to avoid bankruptcy. The IMF said it hasn't received any kind of request from Ireland but it's ready to provide any support to the country if it needs. The rumors were denied by the Irish government over the weekend. According to a Finance Ministry official, while 'ongoing contacts continue at official level with international colleagues in light of current market conditions, Ireland has made no application for external support'. The official added that the government is 'fully funded till well into 2011'. |

| Economic Indicators Update | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea: USD/CHF – Buy at 0.9890Yesterday's rally after breaking resistance at 0.9872 (now turned into support) signals recent upmove is still in progress and further gain to psychological resistance at 1.0000 is likely, however, near term overbought condition should limit upside to 1.0028 (1.618 times projection of 0.9548 to 0.9768 measuring from 0.9672) and 1.0055/60 (100% projection of 0.9463 to 0.9972 measuring from 0.9548) should hold from here. Trade Idea: GBP/USD – Sell at 1.5980The British pound tumbled after breaking previous support at 1.5985 and 1.5952, suggesting recent decline from 1.6300 top is still in progress and further weakness to 1.5810/15 (1.618 times projection of 1.6185 to 1.6015 measuring from 1.6087), however, near term oversold condition should limit downside to 1.5798 (50% Fibonacci retracement of 1.5296 to 1.6300) Candlesticks Intraday Trade Ideas Update Schedule (GMT): Elliott Wave Daily Trade Ideas Update Schedule (GMT): | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment