| Having trouble viewing this email? Click here |

|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

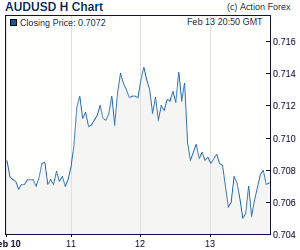

Mid-Day Report: Sterling Drops as Markets Rethink BoE, AUD/USD Breaks Parity after RBA HikeSterling weakens considerably today after Construction PMI missed expectations and dropped sharply from 53.8 to 51.6 in October. More importantly, it's believed that traders are rethinking whether BoE would really hold their hands on the quantitative easing program. The pound has been strong recently as the Q3 GDP growth of 0.8% qoq, which doubled forecasts of 0.4% qoq, eased the need for BoE to expand the GBP 200b asset purchase plan. However, UK is still facing tough austerity measures from the government, a weak banking sector and fragile housing markets. Also, Fed's QE2 might also have some pulling effect on BoE. Today's unexpected RBA hike also reminds investors and traders that central banks do surprise the market sometimes and BoE is among those who are quite unpredictable. After all, we'll seeing a sharp rebound in EUR/GBP which might continue for a while and head to 0.88 and above. | |

| Featured Technical Report | |

AUD/USD Mid-Day OutlookDaily Pivots: (S1) 0.9817; (P) 0.9865; (R1) 0.9918; More AUD/USD rises further to as high as 1.0022 so far and the development confirms that recent up trend has resumed. Intraday bias remains on the upside for the moment and further rise should be seen to 61.8% projection of 0.6008 to 0.9404 from 0.8066 at 1.0165 next. On the downside, below 0.9914 minor support will turn intraday bias neutral first. But break of 0.9651 support is needed to be first sign of topping. Otherwise, outlook will remains bullish. |

| Forex Brokers | ||||||

|

| Special Reports |

RBA Unexpectedly Raises Cash Rate to 4.75%The RBA surprisingly raised the cash rate by +25 bps to 4.75%. While we had expected one more rate hike will be seen in the fourth quarter, we forecast it would be in December. The central bank hike the policy rate, despite weaker-than-expected inflation in 3Q10, stagnant business credit, strength in AUD and potential QE2 from the Fed, amid anticipation that inflation will accelerate in the medium-term as driven by rallies in commodity prices and tightening job market. With this hike, we believe the RBA is done for the year and is likely to leave rates unchanged until 2011. Fed to Spark QE2, What Options Does it Have?The Fed is almost certain to announce QE2 at the November FOMC meeting. Indeed, comments from Fed officials in recent weeks have indicated further accommodations are required to bring inflation and employment back to levels the FOMC sees as consistent with its dual mandate. We expect policymakers are inclined to a more gradual approach of monetary easing, i.e. to purchase long-term Treasury securities of around $100B per month, without upper limit on the total amount and being reviewed on every FOMC meeting. At the same time, the Fed may modify the language used in the accompanying statement as Chairman Ben Bernanke said at the Boston Fed conference that he would examine ways to achieve greater easing through a new communication strategy. |

| Economic Indicators Update | | ||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | |||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea Update: USD/CHF – Sell at 0.9855Current selloff below the Ichimoku cloud signals top has been formed at 0.9972 yesterday and consolidation with downside bias is seen for test of 0.9804 support, however, break there is needed to add credence to this view and bring retracement of recent upmove to 0.9770/80 Trade Idea Update: EUR/USD – Buy at 1.3980Current breach of indicated resistance at 1.4012 suggests the rise from 1.3734 is still in progress and further gain towards 1.4080 would be seen, however, break there is needed to retain bullishness and signal upside break of early established broad range has taken place, then headway to 1.4120/30 would follow, otherwise, further choppy trading cannot be ruled out. Candlesticks Intraday Trade Ideas Update Schedule (GMT): Elliott Wave Daily Trade Ideas Update Schedule (GMT): | |||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | |||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights

| |||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment