| Having trouble viewing this email? Click here |

|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

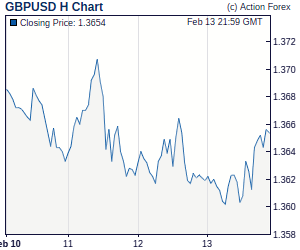

Mid-Day Report: Dollar Recovery after China Raises Reserve Requirement RatioDollar is trying to recovery from intraday low after market sentiments are weighed down mildly by more tightening from China. China raised the so called bank reserve requirement ratio by 50bps to "appropriately control" credit and loans. This was the second reserve increase in two weeks as inflation is viewed as a serious threat to the Chinese economy. There are still speculations that rate hike is imminent, in addition to the current measures. Major European indices turn red after the news while US markets are also pointing to a mildly lower open. | |

| Featured Technical Report | |

USD/JPY Mid-Day OutlookDaily Pivots: (S1) 83.15; (P) 83.47; (R1) 83.83; More. Intraday bias in USD/JPY remains neutral and some more sideway trading could be seen below 83.77 temporary top. Nevertheless, another rise is expected with 81.64 support intact and above 83.77 will target 100% projection of 80.29 to 82.78 from 81.64 at 84.13 next. Break there will put 85.92 key resistance level into focus. However, break of 81.64 will indicate that rebound from 80.29 is completed and will flip bias back to the downside for retesting this low. |

| Forex Brokers | ||||||

|

| Special Reports |

China's Rate Hike Imminent Amid Higher Inflationary Pressures In Coming MonthsSpeculations for China's rate hike intensified after the country's CPI surged +4.4% y/y in October, far exceeding the target of +3%. A majority of analysts forecast the People's Bank of China will lift interest rates as soon as in December. On Wednesday, the State Council said on Wednesday that it may impose temporary measures, including price caps on important daily necessities and a crackdown on speculations on agricultural futures, to curb inflation. In our opinion, these controls are insufficient to lower strength in price level and the government may need to accelerate tightening, e.g. raising interest rates, widening RMB's trading band and imposing stricter bank regulations, to achieve its goal. |

| Economic Indicators Update | | |||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | ||||||||||||||||||||||||||||

Trade Idea Update: EUR/USD – Sell at 1.3770Although euro has eased after intra-day rise to 1.3733, reckon the Kijun-Sen (now at 1.3658) would limit downside and near term rise from 1.3446 may extend one more rise, however, as this move is viewed as retracement of recent decline, reckon upside would be limited and renewed selling interest should emerge around 1.3765/70 (38.2% Fibonacci retracement of 1.4283 to 1.3446), bring retreat later. Trade Idea Update: USD/JPY – Buy at 82.60Although the greenback has rebounded after holding above indicated support at 83.03 and consolidation would be seen, as long as yesterday's high at 83.79 holds, another corrective fall cannot be ruled out and break of said support would signal a minor top is formed, bring retracement of recent upmove to 82.72 (50% Fibonacci retracement of 81.64 to 83.79) but renewed buying interest should emerge above 82.55 (38.2% Fibonacci retracement of 80.54 to 83.79) and bring another rise later Candlesticks Intraday Trade Ideas Update Schedule (GMT): Elliott Wave Daily Trade Ideas Update Schedule (GMT): | ||||||||||||||||||||||||||||

| Suggested Readings | ||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights

| ||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment