| Having trouble viewing this email? Click here |

|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

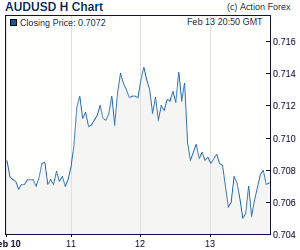

Mid-Day Report: Dollar Selloff Continues as Traders Staring to Bet on QE3 and MoreDollar's selloff continues today as markets are starting to but in QE3 and more after QE2 was just announced by Fed yesterday. Risky assets are broadly higher with major European indices broadly up over 1.5% while Japanese Nikkei jumped 2.17%. Strength in equities also take higher to above 86 level. The QE3 speculations also send dollar index through 76.15 support to as low as 75.80 so far. EUR/USD manages to stay firm above 1.42 level after ECB left rates unchanged at 1.00% as widely expected. . Sterling also extends its rally after BoE left rates changed and maintained the asset purchase program at GBP 200b. Commodity currencies are generally strong in this risk-taking environment with AUD/USD making new record high above 1.01 level. | |

| Featured Technical Report | |

GBP/USD Mid-Day OutlookDaily Pivots: (S1) 1.6001; (P) 1.6085; (R1) 1.6165; More. GBP/USD's rally extends further after brief consolidations and rises to as high as 1.6263 so far. At this point intraday bias remains on the upside and further rise should be seen to 100% projection of 1.5296 to 1.6104 from 1.5649 at 1.6457 next. On the downside, below 1.6088 minor support will turn intraday bias neutral and bring retreat. But downside should be contained above 1.5649 support and bring another rise. |

| Forex Brokers | ||||||

|

| Special Reports |

Fed Announces To Buy $600B Of Bonds Through 2Q11The Fed announced to buy $600B of US Treasury securities by the end of June 2011. Compared with consensus of $500 over 6 month s (around $80B/month), the total size of the program is bigger. However, as it covers 8 months, the purchase every month is only around $75B/month. If we take into account Fed's tentative reinvestment in MBS proceeds, the total level of Treasury purchases will average close to $110B/month, totaling $880B through June 2011. The Fed also made notable changes in the accompanying statement. In the concluding paragraph, policymakers will employ tools to help ensure that inflation is 'at levels consistent with its mandate'. We believe the program is inline with market expectations and recent decline in USD has largely priced in the measures. |

| Economic Indicators Update | | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea Update: USD/CHF – Sell at 0.9720Despite intra-day breach of previous support at 0.9662, lack of follow through selling suggests consolidation would be seen and recovery to 0.9720/25 cannot be ruled out, however, the Kijun-Sen (now at 0.9737) should limit upside and bring another decline later. Trade Idea Update: GBP/USD – Buy at 1.6160As the British pound has surged again partly due to cross-buying in sterling, suggesting recent upmove is still in progress and further gain towards 1.6290/00 would be seen, however, near term overbought condition should prevent sharp move beyond 1.6320/25 (100% projection of 1.5731 to 1.6090 measuring from 1.5962) and risk from there is seen for a retreat later. Candlesticks Intraday Trade Ideas Update Schedule (GMT): Elliott Wave Daily Trade Ideas Update Schedule (GMT): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment