| Having trouble viewing this email? Click here |

| |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

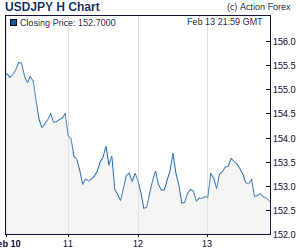

Daily Report: Risk Aversion Comes Back on Moody's Spain Warning, China Inflation, Japan ConfidenceDollar stages a strong rebound today as markets sentiments are weighed down by a couple of risk aversion factors. Firstly, Moody's warned that Spain's Aa1 debt rating is put of review for a possible downgrade. Secondly, Japan's Tankan survey showed first drop in large manufacturer confidence since the end of the finance crisis. Thirdly, a China PBoC survey showed Chinese consumers in deepest concern on inflation in the last ten years which revived speculations of rate hike again. In addition to that, dollar is supported by the late rise in treasury yield post FOMC. Note that while the greenback recovers, key near term levels in EUR/USD, USDCHF, USD/JPY and AUD/USD are still holding there is no solid evidence to turn bullish in the greenback yet. | |

| Featured Technical Report | |

USD/CHF Daily OutlookDaily Pivots: (S1) 0.9539; (P) 0.9614; (R1) 0.9669; More. Intraday bias in USD/CHF remains on the downside with 0.9689 minor resistance intact. Current fall from 1.0065 is still expected to continue to 0.9547 support first. As noted before, fall from 1.0065 is tentatively treated as resumption of the larger down trend. Below 0.9547 will likely bring USD/CHF through 0.9462 low to 100% projection of 1.2296 to 0.9916 from 1.1729 at 0.9349 next. On the upside, above 0.9689 minor resistance will turn intraday bias neutral and bring consolidations. But upside should be limited well below 0.9914 resistance and bring fall resumption. |

| Forex Brokers | ||||||

|

| Special Reports |

Fed Ended the Policy Year SilentlyThe December FOMC meeting contained few surprises. Despite modest change in the language used, the message was the same as the November one. There were slight upward revisions to the economic outlook while inflation was describing as downward trending. The committee decided to leave the Fed funds rate unchanged at 0-0.25% and the asset-purchase program at $600B. Kansas City Fed President Thomas Hoenig was once again the only member voting against the policy. Appreciation In Franc Diminishes The Need Of SNB Rate HikeSwitzerland is one of the healthiest nations in Europe in terms of fiscal positions. Unlike many of its neighboring Eurozone nations, the country does not need to implement fiscal-consolidative measures next year and the government even revised its budget forecast to a surplus of 0.25% of GDP in 2010, up from mild deficit previously projected. The well-being in fiscal stability has attracted foreign investments and sent Swiss franc higher. Strength in the franc, together with sovereign concerns in peripheral economies in the Eurozone, has real impact on economic growth. GDP growth eased for 2 consecutive quarters in 3Q10 as exports contracted significantly. Risks on growth are to the downside in coming quarters and the SNB should keep the 3-monh LIBOR target range unchanged at 0-0.75% in December. |

| Economic Indicators Update |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Forex Trade Ideas | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea: GBP/USD – Sell at 1.5805Despite yesterday's brief rise to 1.5911, the subsequent selloff signals a top has been formed and cable has fallen again after meeting renewed selling interest below the Kijun-Sen, suggesting bearishness remains for this fall to extend to 1.5700 and possibly previous support at 1.5668 but break of latter level is needed to retain bearishness and suggest recent rise has ended Trade Idea: EUR/USD – Sell at 1.3360Although the single currency rose to 1.3500 yesterday's the subsequent selloff from there suggests a top has been formed there and consolidation with downside bias is seen for weakness to 1.3260 and then towards 1.3235 (50% Fibonacci retracement of 1.2969 to 1.3500), however, near term oversold condition would limit downside and support at 1.3182 should hold. Candlesticks Intraday Trade Ideas Update Schedule (GMT): Elliott Wave Daily Trade Ideas Update Schedule (GMT): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment