|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

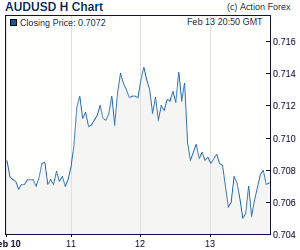

Daily Report: AUD Sharply Lower as Investors Sell Australia, Dollar Consolidation ContinuesWhile European majors are somewhat stabilized, selling focus has turned to Australian dollar as the commodity currency is sharply lower across the board today, with AUD/USD down to eight month low of 0.8254. Aussie's weakness is clearly felt even against other commodity currencies as AUD/CAD dives through 0.8793 medium term support to as low as 0.8688. AUD/NZD also breaks recent low of 1.2391 to as low as 1.2256. While risk aversion is certainly a factor in Aussie's free fall considering broad based decline in Asian stocks, there must be some additional reasons as dollar and yen are relatively steady against European majors only. |    |

| Featured Technical Report | |

EUR/CHF Daily OutlookDaily Pivots: (S1) 1.4085; (P) 1.4197; (R1) 1.4390; More EUR/CHF jumped to as high as 1.4307 on SNB intervention before turning sideway. At this point, intraday bias remains on the upside as long as 1.4216 minor support holds and further rally is in favor to 1.4333 resistance and above. However, note that we'd continue to anticipate strong resistance between 1.4333/4465 to limit upside. On the downside, below 1.4216 minor will suggest that buying pressure has eased temporarily and turn bias neutral. |

| Forex Brokers | ||||||

|

| Special Report |

Fed Discussed About Asset Sales, Raised Growth Outlook For 2010The Fed raised its forecast on US economic growth for 2010 and revised down estimates for CPI and unemployment rate, as shown in the FOMC minutes for April';s meeting. Participants expected the economic recovery to continue, but, consistent with experience following previous financial crises, most anticipated that the pickup in output would be rather slow relative to past recoveries from deep recessions. A moderate pace of expansion, in turn, would imply only a modest improvement in the labor market this year, with the unemployment rate declining gradually. UK's New Era: Fiscal Consolidation and Monetary StanceThe Conservative-Liberal Democrat coalition released a document listing major agreements reached between the parties. What the market cares the most are the fiscal-consolidation plans. Before the alliance, Conservatives and Lib Dems had diverged views on the pace of cutting deficits. While the Conservatives preferred to cut deficits, primarily through spending cut, as soon as in 2010, Lib Dems sought to adopt a progressive way and begin fiscal tightening in 2011/12, with the spending cut/tax hike ratio around 2.5/1. However, the parties eventually agreed that a 'significantly accelerated reduction in the structural deficit over the course of a Parliament, with the main burden of deficit reduction borne by reduced spending rather than increased taxes'. |

| Candlesticks and Ichimoku Intraday Trade Ideas | Attend The Traders Expo in Los Angeles, June 9-12, at the Pasadena Convention Center; your best opportunity in 2010 to meet face to face with the experts, test the latest products and software, and network with other traders to find out what’s working for them…and what isn’t. Attend free, learn from trading experts, and become a more confident, profitable trader. Register FREE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea: GBP/USD – Buy at 1.4255Although cable has retreated partly due to cross-selling against Japanese yen on risk aversion, as yesterday's rebound from 1.4238 to 1.4467 suggests a temporary low has been formed there, reckon downside would be limited and this support should hold, bring another leg of corrective upmove later. Trade Idea: EUR/USD – Buy at 1.2255Although euro has retreated after rising to 1.2433 this morning and weakness to the Kijun-Sen (now at 1.2290) is likely, however, renewed buying interest should emerge around 1.2250/55 (approx. 61.8% Fibonacci retracement of 1.2143 to 1.2433) and the Ichimoku cloud bottom (now at 1.2239) should hold, bring another rebound later. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Economic Indicators Update | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment