|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

Daily Report: Markets in Range as Sentiments StabilizedForex markets are generally staying in range as sentiments stabilized follow late rebound in US stocks. Both DOW and S&P 500 breached February's low briefly but buying emerged right there. DOW managed to hold on to 10000 level while S&P 500 even closed slightly higher. Asian stocks followed and recovered with Nikkei pared some of this week's loss and rose mildly by 0.78%. Crude oil is way above yesterday's low of 67.15 but fails to stay above 70 level so far. Dollar index lost momentum ahead of 87.46 resistance and remains soft for the moment. Gold also extends this week's recovery and is trading above 1200 level for the moment. It looks like risk averse traders' firepower is diminishing somewhat and we'd be seeing more consolidations today. |    |

| Featured Technical Report | |

AUD/USD Daily OutlookDaily Pivots: (S1) 0.8136; (P) 0.8206; (R1) 0.8346; More Despite breaching 0.8069 briefly, AUD/USD failed to sustain below and recovered. Consolidations from 0.8069 is likely still in progress and intraday bias remains neutral for the moment. Stronger recovery cannot be ruled out but we'd expect upside to be limited by 38.2% retracement of 0.9077 to 0.8069 at 0.8454 and bring fall resumption. On the downside, decisive break of 0.8069 will confirm fall resumption and should target next key support level at 0.7702. |

| Forex Brokers | ||||||

|

| Special Report |

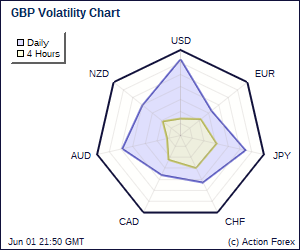

Why Did AUD Tumble Over the Past Few Weeks?Same as any other FX investor, we are stunned by Australian dollar's slump in recent weeks. Although we understand risk aversion has triggered selloff and long liquidation of the currency, the magnitude of the decline has exceeded what was implied by risk aversion. AUDUSD's rally since the beginning of the year reversed after price faltered below 2009-high of 0.9434 on April 11. The decline has accelerated recently and price plummeted to a 10-month low at 0.8071 before rebounding to 0.83 last week. The pair has dropped -10% over the past 3 weeks. Apart from USD, AUD also plunged against EUR (-5%), JPY (-15%) and GBP (-5%), etc. On average, Australian dollar has declined more than -10% against major currencies. |

| Economic Indicators Update | Attend The Traders Expo in Los Angeles, June 9-12, at the Pasadena Convention Center; your best opportunity in 2010 to meet face to face with the experts, test the latest products and software, and network with other traders to find out what’s working for them…and what isn’t. Attend free, learn from trading experts, and become a more confident, profitable trader. Register FREE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

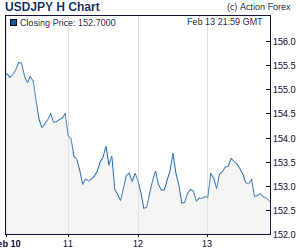

Trade Idea: USD/JPY – Hold short entered at 90.25Although the greenback rose to 90.51 this morning partly due to cross-selling in Japanese yen, as price has retreated from there, retaining our bearishness and as long as this level holds, mild downside bias remains another retreat, break of the Kijun-Sen (now at 89.88) would signal rebound from 89.26 is over, then another fall to 89.22-26 support would follow. Trade Idea: EUR/USD – Exit short entered at 1.2350Despite yesterday's cross-inspired rise to 1.2388, as the single currency met renewed selling interest well below the Ichimoku cloud bottom and has retreated from there, retaining our bearishness and weakness to 1.2220/30 is likely. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment