|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

Mid-Day Report: Euro Soft in Consolidative MarketsWhile markets are generally in consolidation today, Euro is noticeably soft. EUR/CHF has another fall to as low as 1.4175. EUR/AUD and EUR/CAD dive to 1.4754 and 1.3065, way off last week's high of 1.5455 and 1.4710 respectively. EU unveiled its proposal for EU countries to form national funds to insure against future bank failures. The plan would be financed mainly by levies on banking industry. Separate national funds should also be part of an E.U. network. Some debate is expected among EU governments on the proposal but EU is hoping to gain enough endorsement to push it through G20 meeting at the end on June. |    |

| Featured Technical Report | |

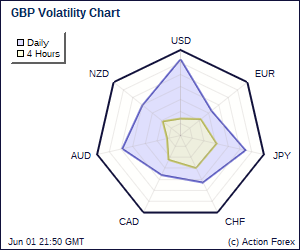

GBP/USD Mid-Day OutlookDaily Pivots: (S1) 1.4302; (P) 1.4363; (R1) 1.4467; More Intraday bias in GBP/USD remains neutral as consolidations from 1.4230 continues. Nevertheless, another fall is still expected as long as 1.4527 resistance holds. Break of 1.4230 will confirm down trend resumption for 100% projection of 1.6456 to 1.4783 from 1.5521 at 1.3848 next. However, break of 1.4527 will suggest that a short term bottom is formed and bring stronger rebound towards 1.5053 resistance before staging another fall. |

| Forex Brokers | ||||||

|

| Special Report |

Why Did AUD Tumble Over the Past Few Weeks?Same as any other FX investor, we are stunned by Australian dollar's slump in recent weeks. Although we understand risk aversion has triggered selloff and long liquidation of the currency, the magnitude of the decline has exceeded what was implied by risk aversion. AUDUSD's rally since the beginning of the year reversed after price faltered below 2009-high of 0.9434 on April 11. The decline has accelerated recently and price plummeted to a 10-month low at 0.8071 before rebounding to 0.83 last week. The pair has dropped -10% over the past 3 weeks. Apart from USD, AUD also plunged against EUR (-5%), JPY (-15%) and GBP (-5%), etc. On average, Australian dollar has declined more than -10% against major currencies. |

| Economic Indicators Update | Attend The Traders Expo in Los Angeles, June 9-12, at the Pasadena Convention Center; your best opportunity in 2010 to meet face to face with the experts, test the latest products and software, and network with other traders to find out what’s working for them…and what isn’t. Attend free, learn from trading experts, and become a more confident, profitable trader. Register FREE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

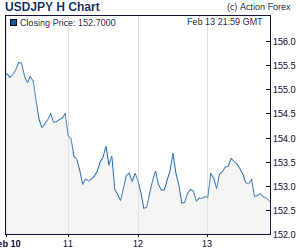

Trade Idea Update: EUR/USD – Sell at 1.2320Although the single currency rebounded in European session, renewed selling interest emerged right at the Ichimoku cloud bottom and price has fallen again from 1.2344/45, suggesting consolidation with downside bias would be seen but break of support at 1.2177 is needed to signal early downtrend has resumed for retest of 1.2143 and later towards 1.2100. Trade Idea Update: USD/JPY – Hold short entered at 90.25Although dollar rebounded again partly due to cross-trading, as long as indicated intra-day resistance at 90.51 holds, further consolidation would be seen and mild downside bias remains for test of the convergence of Ichimoku cloud bottom and Kijun-Sen (now both at 89.88), break there would signal rebound from 89.26 is over, then another fall to 89.22-26 support would follow. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Elliott Wave Daily Trade Ideas | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea: EUR/JPY – Buy at 110.00Although the single currency resumed recent downtrend and fell to as low as 108.83 yesterday, as euro has rebounded from there to 111.95 this morning, suggesting a temporary low has possibly been formed and consolidation would be seen. Break of said resistance would bring retracement to 113.20/25, however, reckon resistance at 114.40 should hold from here. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment