|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

Mid-Day Report: Yen and Dollar Extends Rally, Financial System Stress HeightensThe Japanese yen, and to a lesser extent dollar, jump sharply higher today as global stock markets are weighed down by fear of contagion effect from Spain's banking problems. Major European indices are down over -3% in the middle of the day before recovering mildly, following -3.0% fall in Nikkei. Libor on for three-month loans in dollars jumps for the 11th day to a 0.536% and is set to double the 0.3% level in early May when Europe's sovereign-debt crisis began to balloon. Crude oil drops further to 67.31 so far while gold is steady around 1190 level. Dollar index is now pressing this month's high of 87.46. US equities are set to open sharply lower and should provide additional support to yen and dollar. |    |

| Featured Technical Report | |

EUR/JPY Mid-Day OutlookDaily Pivots: (S1) 110.81; (P) 112.09; (R1) 112.97; More. EUR/JPY's break of 109.48 confirms that recent down trend has resumed. Intraday bias remains on the downside and further decline should be seen to 61.8% projection of 169.96 to 112.10 from 139.21 at 103.45 next. On the upside, break of 114.39 minor resistance will argue that a short term bottom is formed with bullish convergence condition in 4 hours MACD and RSI. In such case, stronger rebound should be seen, possibly towards 122.27 resistance. |

| Forex Brokers | ||||||

|

| Special Report |

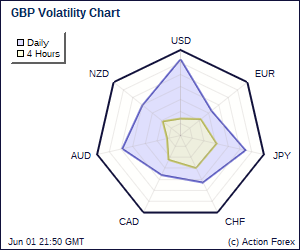

Why Did AUD Tumble Over the Past Few Weeks?Same as any other FX investor, we are stunned by Australian dollar's slump in recent weeks. Although we understand risk aversion has triggered selloff and long liquidation of the currency, the magnitude of the decline has exceeded what was implied by risk aversion. AUDUSD's rally since the beginning of the year reversed after price faltered below 2009-high of 0.9434 on April 11. The decline has accelerated recently and price plummeted to a 10-month low at 0.8071 before rebounding to 0.83 last week. The pair has dropped -10% over the past 3 weeks. Apart from USD, AUD also plunged against EUR (-5%), JPY (-15%) and GBP (-5%), etc. On average, Australian dollar has declined more than -10% against major currencies. EU Crisis Update: Market Remained Weak Despite Stabilization. Risk To The DownsideAfter a meeting in Brussels last Friday, EU finance ministers agreed to impose tougher sanctions against member countries that do not adhere to the region's budget rules. Policymakers agreed to reach greater budget discipline, find ways to reduce the divergence in competitiveness between the member states, endorse a crisis management mechanism in order to deal with deficit crisis should it happen again as well as strengthen economic governance so as to act in a more coordinated and efficient manner. |

| Economic Indicators Update | Attend The Traders Expo in Los Angeles, June 9-12, at the Pasadena Convention Center; your best opportunity in 2010 to meet face to face with the experts, test the latest products and software, and network with other traders to find out what’s working for them…and what isn’t. Attend free, learn from trading experts, and become a more confident, profitable trader. Register FREE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

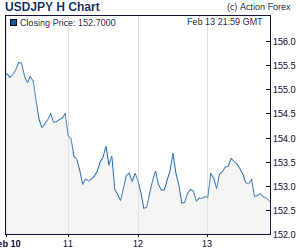

Trade Idea Update: GBP/USD – Sell at 1.4360Cable broke below support at 1.4317 as suggested in our previous update, indicating the correction from 1.4228 has ended at 1.4529 and bearishness remains for decline to resume for subsequent retest of 1.4228, however, break there is needed to retain bearishness and extend fall towards 1.4160/70 but reckon 1.4131 (50% projection of 1.5046 to 1.4249 measuring from 1.4529) would hold. Trade Idea Update: USD/JPY – Sell at 90.25Although dollar has recovered from 89.58, as price dropped below the Ichimoku cloud bottom, suggesting the recovery from 88.95 has possibly ended at 90.75 and consolidation with downside bias remains for test of 89.22 support, however, break there is needed to confirm decline from 93.65 has resumed and bring retest of 88.95, then towards 88.45/50 later. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Elliott Wave Daily Trade Ideas | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea: AUD/USD – Sell at 0.8250The Australian dollar dropped again yesterday in tandem with euro, adding credence to our bearish count that only wave iii of a has ended at 0.8088 and wave iv has also ended, break of 0.8088 would extend weakness to psychological support at 0.8000. Trade Idea Update: USD/JPY – Sell at 90.25Although dollar has recovered from 89.58, as price dropped below the Ichimoku cloud bottom, suggesting the recovery from 88.95 has possibly ended at 90.75 and consolidation with downside bias remains for test of 89.22 support, however, break there is needed to confirm decline from 93.65 has resumed and bring retest of 88.95, then towards 88.45/50 later. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment