|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

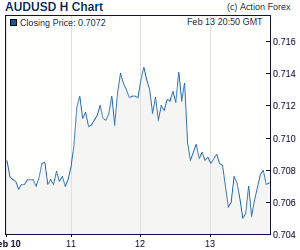

Daily Report: Yen Crosses Extend Rally, Aussie Left Behind after Tame CPIYen crosses continue to march higher as the Japanese yen is broadly pressured on risk appetite trades as stocks are boosted by strong earning reports from Canon Inc. Nikkei jumped 2.7% while MSCI Asia Pacific Index also rose over 1%. Both EUR/JPY and GBP/JPY extend recent rise after taking out 113.40 and 136.39 resistance yesterday. Nevertheless, selling pressure in dollar is much less apparent after worse than expected consumer confidence data released overnight. Meanwhile, Australian dollar is lagging behind and the Aussie tumbles after tamer than expected consumer inflation reading. US durable goods, Fed's Beige Book and RBNZ rate decision will be the main focus in the next 24 hours. | |

| Featured Technical Report | |

EUR/JPY Daily OutlookDaily Pivots: (S1) 113.18; (P) 113.80; (R1) 114.83; More EUR/JPY's rally is still in progress and reaches as high as 114.72 so far. Intraday bias remains on the upside for 100% projection of 107.30 to 113.36 at 110.00 at 116.06 next and possibly further to 38.2% retracement of 139.21 to 107.30 at 119.48. On the downside, below 113.40 minor support will turn intraday bias neutral and bring retreat. But short term outlook will remain bullish as long as 110.00 support holds. |

| Forex Brokers | ||||||

|

| Economic Indicators Update | Attend The Futures & Forex Expo Las Vegas, September 23-25, at Caesars Palace, where industry experts will help Forex & Futures traders make profitable trading decisions. Register FREE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea: USD/JPY – Buy at 87.50As the greenback has maintained a firm undertone after yesterday's rally to 87.97, suggesting the rise from 86.27 low is still in progress and further gain to 88.02-03 (previous support and 61.8% Fibonacci retracement of 89.12 to 86.27) is under way, above there would extend to 88.50/60 but reckon loss of near term upward momentum would limit upside to resistance area at 89.12-15 and risk from there has increased for a retreat later. Trade Idea: GBP/USD – Buy at 1.5500Although current breach of 1.5600 signals recent upmove is still in progress and may extend gain to 1.5645/50 (50% projection of 1.5125 to 1.5530 measuring from 1.5443), loss of near term upward momentum should prevent sharp move beyond there and reckon 1.5690/95 (61.8% projection) would hold from here, bring correction later. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment