|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

Mid-Day Report: Dollar Back Under Pressure after GDP DisappointmentDollar is back under pressures in early US session after Q2 GDP report showed slightly worse than expected growth of 2.4% annualized. The data reflected slowing consumer spending, which dropped from 1.9% to 1.6% in Q2, as well as widened trade deficit from $338b to $426b. Earlier, IMF said note in US "private demand has been sluggish, while the unemployment rate has receded only modestly from near post-Depression highs". IMF warned that "risks are elevated and tilted to the downside, with particular risks from a double dip in the housing market and spillovers if external financial conditions worsen". Also, IMF said that US financial system remains fragile and as much as $76b in capital is needed to ease the stress in the system. | |

| Featured Technical Report | |

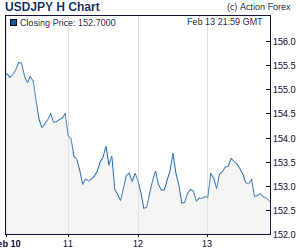

USD/JPY Mid-Day OutlookDaily Pivots: (S1) 86.40; (P) 86.95; (R1) 87.34; More. USD/JPY's fall extends further to as low as 85.98 in early US session. Intraday bias remains on the downside and current decline from 94.97 is expected to continue to retest 84.81 low next. On the upside, above 86.56 minor resistance will turn bias neutral and bring consolidations. But recovery should be limited below 88.11 resistance and bring fall resumption. |

| Forex Brokers | ||||||

|

| Economic Indicators Update | Attend The Futures & Forex Expo Las Vegas, September 23-25, at Caesars Palace, where industry experts will help Forex & Futures traders make profitable trading decisions. Register FREE | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea Update: USD/CHF – Sell at 1.0470Although dollar has retreated after intra-day rebound from 1.0362 to 1.0449, break of said support is needed to confirm recent decline has once again resumed and extend weakness towards 1.0320/30 and possibly 1.0300, otherwise, further consolidation is in store and another corrective bounce to 1.0465/70 (38.2% Fibonacci retracement of 1.0640 to 1.0362) cannot be ruled out but renewed selling interest should emerge there and bring another decline later. Trade Idea Update: EUR/USD – Hold long entered 1.3020Although the single currency fell sharply to 1.2980 in European session, as euro is able to hold above indicated minor support at 1.2977 (yesterday's low) and has rebounded, retaining our bullishness and as long as this level holds, a retest of yesterday's high at 1.3107 is likely, break would extend recent upmove towards 1.3145/50 but reckon 1.3170/75 (1.618 times projection of 1.2732 to 1.2966 measuring from 1.2794 as well as 50% projection of 1.2151 to 1.3029 measuring from 1.2732) would limit upside and 1.3200 should hold from here, bring correction later. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment