|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

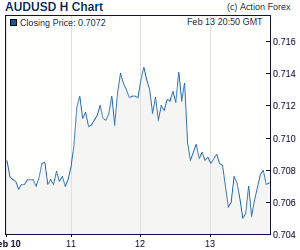

Daily Report: Dollar and Yen Back Under Mild Pressure, Kiwi Recovers MildlyDollar and yen are back under mild pressure as European stocks open slightly higher on positive earnings from Siemens AG and BASF SE. GBP/USD leads the way and breaks yesterday high, rises to as high as 1.5651 so far while EUR/USD continue to press 1.305 level. Yen crosses, as well as AUD/USD and NZD/USD, are generally lifted off from yesterday's low. There is no change in risk appetite trend yet and the dollar and yen would likely continue to remain soft for a while. | |

| Featured Technical Report | |

GBP/JPY Daily OutlookDaily Pivots: (S1) 135.65; (P) 136.59; (R1) 137.33; More With 4 hours MACD crossed below signal line, intraday bias in GBP/JPY is turned neutral and some sideway trading might be seen first. Nevertheless, downside should be contained by 134.37 support and bring another rise. Whole medium term rally from 126.73 is expected to continue further and above 137.52 will target 61.8% retracement of 145.94 to 126.73 at 138.60 and above. |

| Forex Brokers | ||||||

|

| Special Reports |

RBNZ Raised OCR To 3%, Signaled Slowdown In Pace Of TighteningThe RBNZ raised the OCR by +25 bps to 3% in June. However, the market was disappointed as the central bank explicitly said that 'the pace and extent of further OCR increases is likely to be more moderate than was projected in the June statement'. The reference is inline with our view that the RBNZ will slow the tightening path later in the year. July's Beige Book Shows Slowdown in GrowthFed's beige Book covering the period spanning mid-June through late-July reported that 'economic activity has continued to increase, on balance, since the previous survey' but economies in 2 (Cleveland and Kansas City) of the Fed's 12 districts 'held steady' while 2 (Atlanta and Chicago) showed slowdown in the pace of expansion. The overall outlook is less optimistic than June's report as the Fed described the economy in all 12 districts as 'continued to improve' at 'modest' pace. |

| Economic Indicators Update | Attend The Futures & Forex Expo Las Vegas, September 23-25, at Caesars Palace, where industry experts will help Forex & Futures traders make profitable trading decisions. Register FREE | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea: GBP/USD – Buy at 1.5550Despite yesterday's marginal rise to 1.5638, as the British pound has retreated thereafter, suggesting minor consolidation would be seen, however, renewed buying interest should emerge around 1.5545-51 (previous support and current level of the Ichimoku cloud top), bring another upmove. Trade Idea: EUR/USD – Buy at 1.2930As the greenback has maintained a firm undertone, bullishness remains for recent upmove to resume after consolidation and break of resistance at 1.3047 would extend gain to 1.3080/85 (1.236 times projection of 1.2732 to 1.2966 measuring from 1.2794) but overbought condition should prevent sharp move beyond 1.3115/20 and reckon 1.3170/75 (1.618 times projection) would hold from here, bring correction later. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment