| Having trouble viewing this email? Click here |

|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

Daily Report: Aussie Jumps on Solid Job Data, Sterling Soft ahead of BoEAustralian dollar jumps on strong employment data today and rises to a four month high against the greenback. Data showed the job market in Australia expected by 30.9k in August, above expectation of 25k and higher than prior month's 25k. Unemployment rate also dropped more than expected from 5.3% to 5.1% in August. The employment data solidifies the case for more tightening from RBA in Q4. The bank is still more likely to hike in November after getting Q3 inflation data on October 28. But markets are starting to raise the bet on October 5. The October meeting will be an interesting one. Elsewhere, Euro's recovery lost momentum and turned south again after ECB Executive Board member Juergen Stark was quoted saying that German banks are in need of more capital. Yen is mildly higher as intervention talk fades. | |

| Featured Technical Report | |

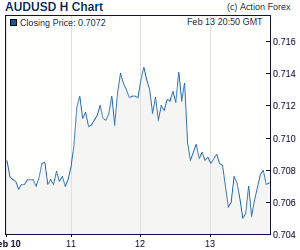

AUD/USD Daily OutlookDaily Pivots: (S1) 0.9120; (P) 0.9157; (R1) 0.9216; More AUD/USD's rally resumes after brief retreat and reaches as high as 0.9235 so far. 0.9220 resistance was also taken out. Intraday bias now remains on the upside and further rise should be seen to 61.8% projection of 0.8315 to 0.9220 from 0.8770 at 0.9329 next. Though, we'll anticipate strong resistance between 0.9329 and 0.9404 to bring reversal. On the downside, break of 0.9091 support will argue that a short term top is formed and turn bias back to the downside for 0.8770 support instead. |

| Forex Brokers | ||||||

|

| Action Insight Market Overview |

Fed's Beige Book Unveiled Deceleration In US GrowthThe Fed's Beige Book shows that US' economic growth moderated further during the period from mid-July to end-August. While the recovery continued to expand, it has shown 'widespread signs of a deceleration'. Of the 12 districts, 5 saw growth at 'a moderate pace', 5 pointed to 'positive developments or net improvements compared with the previous reporting period' and the rest showed 'mixed conditions or deceleration in overall economic activity'. BoC Raises Policy Rate to 1%, Delivers a Less Dovish StatementThe BOC raised its policy rate by +25 bps, taking the overnight target rate to 1%, in September. While it's the third consecutive hike since the central bank resumed the tightening cycle in June, financial conditions in Canada remained 'exceptionally stimulative' and is consistent with BOC's 2% inflation target. The post-meeting statement is not hawkish but it's less dovish that we and the market had anticipated. Perhaps this is the reason for loonie's rally after the announcement. That said, we retain our view that the BOC will pause in October before tightening again in December. |

| Economic Indicators Update | Attend The Futures & Forex Expo Las Vegas, September 23-25, at Caesars Palace, where industry experts will help Forex & Futures traders make profitable trading decisions. Register FREE | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea: USD/CHF – Sell at 1.0200Although dollar's retreat after rebounding from 1.0060 to 1.0141 yesterday suggests consolidation with mild downside bias would be seen, break of said support is needed to confirm downtrend has once again resumed and extend weakness towards psychological support at 1.0000 but oversold condition should prevent sharp fall below there and price should stay well above 2009 low of 0.9910, bring rebound later. Trade Idea: EUR/USD – Sell at 1.2770Although the single currency retreated after yesterday's rebound from 1.2659 to 1.2764, break of said support is needed to confirm the decline from 1.2920 has resumed and extend weakness to 1.2625 and possibly 1.2600, otherwise, further consolidation would take place and another corrective bounce cannot be ruled out, however, the Ichimoku cloud top (now at 1.2797) should cap upside, bring decline later towards recent low at 1.2588. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment