| Having trouble viewing this email? Click here |

|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

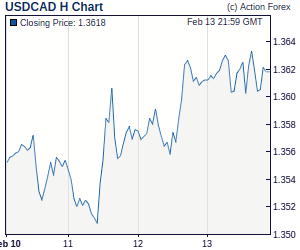

Mid-Day Report: Dollar Steady after Solid Housing Data, Euro Lifted by Successful Bond AuctionsMarkets are steady in early US session as investors await FOMC rate decision. Though, risk appetite might continue to support Aussie. Better than expected housing data from US shows sign of stability in the sector. Housing starts jumped sharply to 598k in August versus expectation of 550k. Building permits also improved to 569k. Canadian dollar is steady in range after weaker than expected inflation reading. Headline CPI unexpectedly moderated from 1.8% yoy to 1.7% yoy in August while core CPI also was unchanged at 1.6% yoy. | |

| Featured Technical Report | |

EUR/USD Mid-Day OutlookDaily Pivots: (S1) 1.3019; (P) 1.3070 (R1) 1.3110; More. EUR/USD recovers strongly today but is still limited below 1.3158. Intraday bias remains neutral and some more consolidations cannot be ruled out. But downside is expected to be contained by 1.2916 resistance turned support and bring another rise. Above 1.3158 will target 1.3330 and above. Though, note that break of 1.2916 will dampen this case and turn focus back to 1.2587/2643 support zone instead. |

| Forex Brokers | ||||||

|

| Special Reports |

Fed To Revise Lower Growth Forecast But Keep Monetary Stance Unchanged For NowWhile there have been rigorous speculations over the past week that the Fed will further expand the balance sheet to stimulate recovery, we expect the central bank will maintain the policy stance to keep interest rates at exceptionally low levels for an extended period time and to maintain the plan to reinvest agency and MBS proceeds. The Fed may, however, revise lower its growth forecasts, signaling economic developments since the last FOMC meeting have deteriorated. We will also see if there's hint in the forward-looking policy indicating additional easing in coming months. Japan's Unilateral Yen Intervention Is Not Going To SustainShortly after the re-election, Japan's Prime Minister Kan surprisingly conducted an intervention in the FX market by buying USD and selling JPY. The timing and the size of the intervention signaled the government's determination and commitment to curb yen's appreciation. The initial impact was encouraging as USDJPY rose more than 3% to 85.78 on September 15 from the low of 82.87 before the intervention and has stayed above 85 thereafter. The question now is whether the intervention is sustainable and if the unilateral intervention can defend the 82 level as implicitly stated by the government. |

| Economic Indicators Update | Attend The Futures & Forex Expo Las Vegas, September 23-25, at Caesars Palace, where industry experts will help Forex & Futures traders make profitable trading decisions. Register FREE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea Update: GBP/USD – Sell at 1.5630As the British pound has remained under pressure, suggesting bearishness remains for the decline from 1.5730 top to bring a stronger retracement of recent rise to indicated downside target at 1.5490-95 (61.8% Fibonacci retracement of 1.5348 to 1.5730), however, reckon support at 1.5449 would hold from here and risk has increased for a rebound later. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment