| Having trouble viewing this email? Click here |

|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

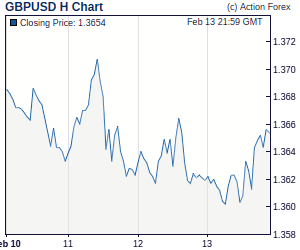

Mid-Day Report: Euro Remains Broadly Pressured But Passing the Torch to SterlingEuro remains broadly weak against major currencies, as pressured by a WSJ report that the European bank stress test "understated some lenders' holdings of potentially risky government debt." EUR/USD's break of 1.2776 minor support suggests that recent recovery is finished and the pair is possibly heading back to 1.2587 low. EUR/JPY is also showing sign that it's resuming recent decline for 105.42 and below. One thing to note is that while EUR/GBP did drop earlier today, strong selling is seen in Sterling into US session while helps that cross recovers. Both GBP/USD and GBP/JPY have indeed broken recent low to resume down trend. We'd probably see Sterling taking over Euro as the main victim in current risk selling. | |

| Featured Technical Report | |

GBP/JPY Mid-Day OutlookDaily Pivots: (S1) 129.00; (P) 129.82; (R1) 130.41; More GBP/JPY drops sharply to as low as 127.99 so far today and the firm break of 128.63 confirms that recent decline from 137.73 has resumed. Intraday bias is now on the downside and further decline should be seen to test 126.73 low next. On the upside, in case of recovery, break of 131.64 resistance is needed to be the first signal of bottoming. Otherwise, outlook will remain bearish. |

| Forex Brokers | ||||||

|

| Action Insight Market Overview |

RBA Said Rates Are Appropriate 'For The Time Being', Signal Of A Hike Soon?As expected, the RBA left the cash rate unchanged at 4.5% as global economic outlook remained uncertain. Policymakers judged that about-trend growth and inflation in the near-term rendered the setting of monetary policy 'appropriate for the time being'. The central bank acknowledged that global economy had grown 'faster than trend' in the first half but it would probably 'ease back to about trend pace over the coming year'. Commenting specifically on developments in China, Europe and the US, the RBA stated that growth in China 'is moderating to a more sustainable rate as policies are now less accommodating'. While 'output has improved significantly' in Europe so far this year, 'prospects for next year are probably for slower growth given planned fiscal contraction'. In the US, growth was 'solid in the first half of 2010 but the pace of expansion in the second half of the year is looking weaker'. |

| Economic Indicators Update | Attend The Futures & Forex Expo Las Vegas, September 23-25, at Caesars Palace, where industry experts will help Forex & Futures traders make profitable trading decisions. Register FREE | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea Update: EUR/USD – Sell at 1.2850Euro's intra-day selloff signals recent rise from 1.2588 low has possibly ended at 1.2920 and consolidation with downside bias remains for further weakness towards 1.2715 (61.8% Fibonacci retracement of 1.2588 to 1.2920), however, near term oversold condition should limit downside and reckon support at 1.2661 would hold and bring rebound later. Trade Idea Update: GBP/USD – Sell at 1.5385Current breach of recent low at 1.5327 confirms early decline from 1.5999 top has resumed and further weakness to 1.5280 (100% projection of 1.5490 to 1.5345 measuring from 1.5425) and possibly towards 1.5210/15 (61.8% projection of 1.5999 to 1.5373 measuring from 1.5599), however, near term oversold condition should limit downside and bring rebound later. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment