| Having trouble viewing this email? Click here |

|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

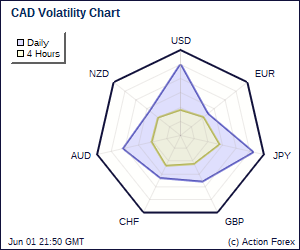

Mid-Day Report: Swiss Recovers as KOF Raised Forecast, Sterling WeakSwiss Franc extends rebound after KOF economic institute raised growth forecast for Switzerland. GDP is expected to grow 2.7% this year, up from 1.8% as projected in June. While the institute sees growth to moderate in 2011, forecast was still raised from 1.6% to 1.8%. Unemployment rate is expected to rise slightly from 3.7% to 3.8% this year and then falls back to 3.2% next year. Inflation is projected to be around 0.8% this year and 0.7% next year and KOF said there is "no noteworthy risks of inflation or deflation." KOF also expects SNB to raise interest raise slightly at the beginning of 2011 but note risk on intervention due to "development on the real estate market." | |

| Featured Technical Report | |

USD/CHF Mid-Day OutlookDaily Pivots: (S1) 1.0049; (P) 1.0115; (R1) 1.0163; More. USD/CHF's fall from 1.0181 extends further today and intraday bias remains cautiously on the downside for the moment. As noted before, rebound from 0.9932 might have completed already and further fall could be seen to 0.9932 and then 0.9916. On the upside, above 1.0117 will bring another rise but, note that with 1.0276 cluster resistance intact, there is no indication of trend reversal yet and recent down trend is still in favor to continue. However, decisive break of 1.0276 will be first sign that USD/CHF has bottomed out in medium term and turn focus to 1.0624/39 resistance zone for confirmation. |

| Forex Brokers | ||||||

|

| Economic Indicators Update | Attend The Futures & Forex Expo Las Vegas, September 23-25, at Caesars Palace, where industry experts will help Forex & Futures traders make profitable trading decisions. Register FREE | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea Update: GBP/USD – Sell at 1.5630As the British pound has fallen again after brief recovery, suggesting top has been formed at 1.5730 last Friday and downside bias remains for at least a strong retracement of recent rise to 1.5536-39 (previous minor support and 50% Fibonacci retracement of 1.5348 to 1.5730) and possibly towards 1.5490-95 (61.8% Fibonacci retracement of 1.5348 to 1.5730), however, support at 1.5449 should hold from here. Trade Idea Update: EUR/USD – Sell at 1.3100Despite intra-day bounce to 1.3122, current cable-led retreat suggests a temporary top has been formed at 1.3160 and consolidation with mild downside bias is seen, break of support at 1.3020 would add credence to this view and bring retracement to 1.2975 (previous minor support and 38.2% Fibonacci retracement of 1.2675 to 1.3160) but reckon minor support at 1.2955 would contain pullback and bring another rally later. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment