|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

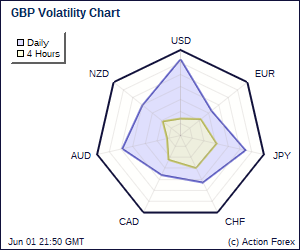

Daily Report: Yen Weakens Further as Kan Gets Support to be Next PMJapanese yen continues to be the weakest major currency as stocks rebound and as Finance Minister Naoto Kan gets closer to succeed Yukio Hatoyama as prime minister. Kan won support from Foreign Minister Katsua Okada who said he'd like Kan to "fulfill Hatoyama's wish to regain the party's spirit lost by money politics." Transport Minister Seiji Maehara also said he will back Kan. Kan is known to support a weak yen policy and expects more from BoJ to take deflation and support growth. Nikkei jumped sharply higher by 3.24% to 9914 today. Japanese yen is broadly lower against other major currencies with USD/JPY up to 92.40. The ruling DPJ will vote for a new head tomorrow. Data from Japan saw capital spending dropped more than expected by -11.5% in Q1. |  |

| Featured Technical Report | |

EUR/JPY Daily OutlookDaily Pivots: (S1) 111.53; (P) 112.29; (R1) 113.60; More. EUR/JPY rebounds further to as high as 113.86 today and the break of 113.67 suggests that more rise would be seen. Nevertheless, there is no change in the view that price actions from 108.82 are merely consolidations to larger fall. Upside is expected to be limited by 38.2% retracement of 127.88 to 108.82 at 116.10 and break fall resumption. On the downside, decisive break of 108.82 low will confirm down trend resumption and should target 61.8% projection of 169.96 to 112.10 from 139.21 at 103.45 next. |

| Forex Brokers | ||||||

|

| Economic Indicators Update | Attend The Traders Expo in Los Angeles, June 9-12, at the Pasadena Convention Center; your best opportunity in 2010 to meet face to face with the experts, test the latest products and software, and network with other traders to find out what’s working for them…and what isn’t. Attend free, learn from trading experts, and become a more confident, profitable trader. Register FREE | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

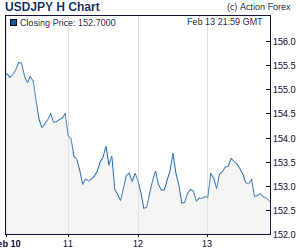

Trade Idea: EUR/USD – Buy at 1.2220Despite yesterday's fall to 1.2175, as the single currency found good support there and staged a strong rebound, retaining our view that further consolidation above support at 1.2110 temporary low would be seen and another leg of corrective upmove is underway towards resistance at 1.2355, however, break there is needed to extend rise towards 1.2395/00 but price should falter well below resistance at 1.2454. Trade Idea: USD/JPY – Buy at 91.95Current firmness partly due to renewed cross-selling in yen suggests recent upmove from 88.95 is still in progress and gain to resistance at 92.97 would be seen, however, loss of near term upward momentum would limit upside and price should falter below resistance at 93.65. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment