|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

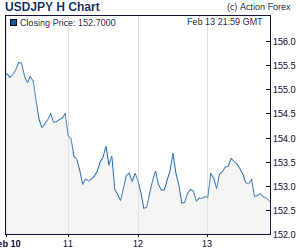

Mid-Day Report: Risk Aversion Lifts Dollar But No Follow Through Buying YetDollar and yen climbed earlier today on renewed concern on Eurozone banking sector and disappointing Chinese manufacturing data. Dollar index breached recent high of 87.46 briefly but lacked follow through momentum to sustain above this level. Canadian dollar had little reaction to BoC rate hike as the statement suggests that today's hike might be a one-off. WTI crude oil dipped to as low as 71.64 before recovering while gold extended recent rebound to as high as 1227.7. Major European stock indices are down over -1.5% at the time of writing. |  |

| Featured Technical Report | |

AUD/USD Mid-Day OutlookDaily Pivots: (S1) 0.8388; (P) 0.8451; (R1) 0.8520; More AUD/USD's break of 0.8323 minor support suggests that recovery from 0.8066 has completed at 0.8549 already. Intraday bias is flipped back to the downside for 0.8066 low first. Break will confirm down trend resumption towards 0.8 psychological level next. On the upside, above 0.8549 will bring another rise. But after all, we'd expect strong resistance at 0.8715 (50% retracement of 0.9380 to 0.8066 at 0.8723) to limit upside and bring fall resumption finally. |

| Forex Brokers | ||||||

|

| Special Report |

RBA On Hold. Economic Data Suggest Previous Tightening Taking Its TollConsistent with market expectations, the RBA left its overnight cash rate unchanged at 4.5% as previous rate hikes have brought interest rates to average levels of the past decade and the central bank needs to gauge impacts of European policymakers' measures to contain sovereign crisis. Interestingly, statement skipped detailed discussions on domestic economy where data showed moderation in recent weeks. |

| Economic Indicators Update | Attend The Traders Expo in Los Angeles, June 9-12, at the Pasadena Convention Center; your best opportunity in 2010 to meet face to face with the experts, test the latest products and software, and network with other traders to find out what’s working for them…and what isn’t. Attend free, learn from trading experts, and become a more confident, profitable trader. Register FREE | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea Update: USD/CHF – Buy at 1.1620Despite intra-day resumption of upmove to 1.1730, as dollar has retreated from there partly due to cross-trading (a shooting doji star was formed on the hourly chart), suggesting consolidation below there would be seen, however, downside should be limited to the convergence of the Tenkan-Sen and Kijun-Sen (now both at 1.1628) and support at 1.1597 (previous resistance) should contain pullback, bring another upmove Trade Idea Update: EUR/USD – Sell at1.2220Euro's selloff after the release of soft economic data in euro-zone and the breach of 1.2143 confirm recent downtrend has resumed and further weakness towards 1.2085/90 (1.236 times projection of 1.2454 to 1.2255 measuring from 1.2335) and possibly 1.2050 is underway, however, oversold condition should limit downside and reckon psychological support at 1.2000 would hold from here. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment