|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

Mid-Day Report: ADP Showed 55k Expansion in May, Dollar Mildly HigherDollar is mildly higher in early US session after ADP report showed 55k expansion in the private job market in May, basically inline with expectation. Prior month's figure was revised up from 32k to 65k. While the data was solid, it doesn't support the view of an exceptionally strong Non-farm payroll figure for tomorrow. Markets are expecting around 500k expansion to be shown by NFP, including around 400k workers hired temporarily to conduct the 2010 Census. Other data released from US saw initial jobless claim remains elevated at 453k. Non-farm productivity was revised lower to 2.8% in Q1 with unit labor cost dropped -1.3%. |  |

| Featured Technical Report | |

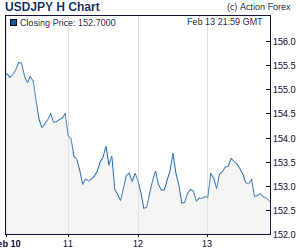

USD/JPY Mid-Day OutlookDaily Pivots: (S1) 91.22; (P) 91.79; (R1) 92.68; More. USD/JPY's rise is still in progress and edges higher to 92.79 in early US session. Intraday bias remains on the upside and further rally might be seen. But after all, as price actions from 88.25 are viewed as consolidative in nature, we'd expect upside to be limited below 93.62 resistance and bring another fall. On the downside, below 92.03 minor support will turn intraday bias neutral first. Further break of 90.53 support will indicate that rebound from 88.97 is completed and will bring retest of 88.13/97 support zone. |

| Forex Brokers | ||||||

|

| Economic Indicators Update | Attend The Traders Expo in Los Angeles, June 9-12, at the Pasadena Convention Center; your best opportunity in 2010 to meet face to face with the experts, test the latest products and software, and network with other traders to find out what’s working for them…and what isn’t. Attend free, learn from trading experts, and become a more confident, profitable trader. Register FREE | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea Update: EUR/USD – Buy at 1.2190Euro's intra-day retreat from 1.2327 reinforces our view that further consolidation would be seen and the broke below the Kijun-Sen suggests weakness to 1.2190 is likely, however, support at 1.2175 (yesterday's low) should limit downside and bring another rebound later. Above resistance at 1.2327 would suggest the corrective rise from 1.2110 temporary low has resumed and then test of next resistance at 1.2355 would follow but break there is needed to confirm and extend to 1.2395/00, however, price should falter well below resistance at 1.2454. Trade Idea Update: USD/JPY – Buy at 92.05As dollar has continued to move higher, suggesting recent upmove from 88.95 is still in progress and further gain to indicated resistance at 92.97 would be seen, above would extend marginally to 93.20/25, however, loss of near term upward momentum would prevent sharp rise beyond chart resistance at 93.65 and risk from there has increased for a correction later. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Elliott Wave Daily Trade Ideas | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea: EUR/JPY – Buy at 112.50Current breach of indicated resistance at 113.67 reinforces our view that wave v has formed a low at 108.83 earlier and consolidation with upside bias remains for retracement to 114.40, above would extend to 115.00 but reckon 115.56 (50% Fibonacci retracement of 122.29 to 108.83) would hold from here. Trade Idea: AUD/USD – Buy at 0.8350As the Australian dollar finally rebounded after finding support at 0.8276 yesterday, adding credence to our view that temporary low has been formed at 0.8066 (wave v of a) and test of 0.8552 would be seen, however, break there is needed to bring stronger retracement in 2nd wave b for gain to 0.8600. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment