| Having trouble viewing this email? Click here |

|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

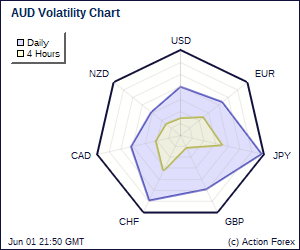

Daily Report: Dollar Extends Weakness, AUD/USD Approaching ParityDollar is sharply lower today on risk appetite as global equities are boosted by strong Q3 earnings from US as well as expectation of more quantitative easing from Fed ahead. Dollar index dives through 76.92 support to resume recent down trend to as low as 76.37 so far. Pressure on greenback is felt everywhere with EUR/USD breaking 1.4 psychological level again while USD/CAD breaches parity. USD/JPY drops to as low as 81.13 so far while AUD/USD is approaching parity. Gold also makes another record high today and is quickly approaching 1390 level. | |

| Featured Technical Report | |

AUD/USD Daily OutlookDaily Pivots: (S1) 0.9845; (P) 0.9891; (R1) 0.9948; More AUD/USD's up trend resumes by taking out 0.9915 resistance and reaches as high as 0.9982 so far today. Intraday bias is back on the upside and further rise should be seen to target parity and then 138.2% projection of 0.8315 to 0.9220 from 0.8770 at 1.0021. Break will see further rise to medium term projection level at 1.0165. On the downside, note that break of 0.9768 support will suggest that a short term top is al least formed, possibly with bearish divergence condition in 4 hours MACD, and bring deeper correction first. |

| Special Report |

Fed Leaned Towards Further Easing, Discussed Ways To Anchor Inflation ExpectationsAs indicated in the September FOMC minutes, policymakers discussed rigorously about implementing additional measures – through QE and strategies to boost inflation expectations- to revive the recovery. It appeared that the majority believed that the actions should be taken 'soon'. The minutes heightened speculations that the Fed will announce more easing measures such as purchase of long-term Treasury bonds in the November meeting. The dollar erased all gains made earlier in the day and ended with losses against major currencies. International Coordination Does Not Necessarily Avoid Currency WarComments from Brazilian Finance Minister Guido Mantega's the world is 'in the midst of an international currency war. This threatens us because it takes away our competitiveness' have sparked worries about the impacts of competitive currency devaluation on the global economic growth. Economists, central bankers and other finance leaders have expressed their concerns about harms that such a war would do on the economy. Olivier Blanchard, the IMF's chief economist, said currency wars between major countries could 'derail the global economy's recovery'. |

| CitiFX Pro Survey Results |

The rapidly expanding foreign exchange (forex) markets have attracted a new, sophisticated breed of individual trader focused almost entirely on forex, according to the first phase results of the CitiFX Pro Forex Trader Survey 2010. This first-ever industry wide survey of forex traders was sponsored by CitiFX Pro and conducted in partnership with major forex media outlets including FXstreet.com, ActionForex, ForexPros and ForexTV. Detailed survey results can be found here. |

| Forex Brokers | ||||||

|

| Economic Indicators Update | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea: USD/CHF – Took profit on short and look to sell again higherAlthough the greenback rebounded from yesterday's low of 0.9544 to 0.9643, dollar ran into heavy offers below the Ichimoku cloud and quickly turned south, the currency pair then resumed recent decline this morning on dollar's broad-based selloff, our short position entered at 0.9620 met downside target at 0.9540 and tumbled to as low as 0.9480 before recovering. Trade Idea: EUR/USD – Took profit on long and look to buy lowerAlthough the single currency retreated from yesterday's high of 1.4002 to 1.3912 (we entered long at 1.3920), as renewed buying interest emerged there as expected, the subsequent rally has justified our bullishness (reached indicated target at 1.4000) and once said resistance at 1.4002 was penetrated, price surged to as high as 1.4098 this morning. Candlesticks Intraday Trade Ideas Update Schedule (GMT): Elliott Wave Daily Trade Ideas Update Schedule (GMT): | Suggested Readings | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment