| Having trouble viewing this email? Click here |

|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

Mid-Day Report: Dollar and Sterling Weak on QE ExpectationsDollar remains generally weak today in reaction to weekend's G20 statement as well as on expectation of QE II and makes new 15 years low against yen. Existing home sales in US rose more than expected to 4.53m annualized rate in September but provides little support to greenback. Noticeable rebound is also seen in gold which jumps back on dollar's weakness but faces some resistance ahead of 1350 level. Sterling is another weak currency today as markets expect Prime Minister Cameron to force BoE to extend the QE campaign too. There is additional pressure on the pound after data showed BBA mortgage approval dropped to 18 month low of 31.1k in September. | |

| Featured Technical Report | |

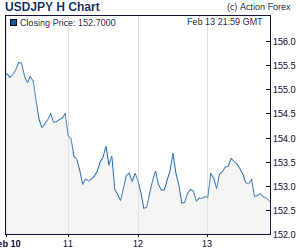

USD/JPY Mid-Day OutlookDaily Pivots: (S1) 81.07; (P) 81.28; (R1) 81.58; More. USD/JPY drops further to as low as 80.40 so far today and at this point, intraday bias remains on the downside. Current decline from 85.92 is expected to continue towards 61.8% projection of 92.87 to 82.86 from 85.92 at 79.73, which is close to 79.75 low. On the upside, though, break of 81.49 will indicate that a short term bottom is formed and bring rebound towards 83.15/83.97 resistance zone instead. |

| Forex Brokers | ||||||

|

| Special Reports |

Net Shorts In USD Stayed At Exceptionally Low LevelsCompared with 4 weeks ago, net shorts in USD soared $46.84B, or +81.54%, to $30.20B in the week ended October 19, driven by additions of net lengths in JPY, EUR, GBP and CAD. Yet, panic selling in USD is temporarily behind us as net shorts in the currency reduced for a second week after reaching a peak of 35.16B on October 5. As USD's downtrend should continue in the near- to medium- term, speculators should remain net sellers of the dollar futures. Multilateral Coordinations Impractical As G-20 Leaders Unlikely To Subordinate Self Interest To Global BalancesG-20 finance ministers and central bank governors agreed to 'move towards more market determined exchange rate systems that reflect underlying economic fundamentals' and 'refrain from competitive devaluation of currencies'. Member countries also pledged to strengthen 'multilateral cooperation to promote external sustainability', reduce 'excessive imbalances' and maintain 'current account imbalances at sustainable levels'. Although the language used in the communiqué was stronger than that in the previous meeting in Toronto, finance leaders failed to agree on a more concrete proposal to resolve currency tensions as it's hard for member countries to alter domestic policies to achieve external balance. Renewed selling interests were seen in USD as the market focus on the upcoming FOMC meeting. While the Fed is widely expected to announce new easing measures, the question now is how much the program will be as a kick start. |

| Economic Indicators Update | | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea Update: USD/CHF – Hold short entered 0.9710Dollar's rebound after holding above previous support at 0.9661 (Friday's low) suggests consolidation would be seen, however, as long as the Kijun-Sen (now at 0.9734) holds, bearishness remains for the fall from 0.9806 to resume, break of said support would confirm top has been formed there and bring at least a strong retracement of the rise from 0.9463 to 0.9635 Trade Idea Update: GBP/USD – Hold long entered at 1.5720As the British pound has edged lower after retreating from 1.5773, suggesting caution on our long position entered at 1.5720 and 1.5690 needs to hold to retain our view that further consolidation above last week's low at 1.5650 would take place, bring another rebound later. Candlesticks Intraday Trade Ideas Update Schedule (GMT): Elliott Wave Daily Trade Ideas Update Schedule (GMT): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment