| Having trouble viewing this email? Click here |

|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

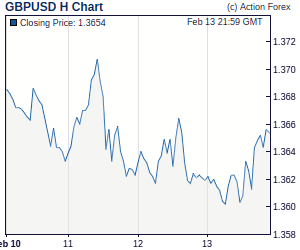

Daily Report: Risky Assets Stabilize, Focus on UKRisky assets stabilize today after yesterday's selloff and dollar retreats mildly. Main focus will turn to UK for the moment as markets await the Comprehensive Spending Review as well as BoE minutes. Chancellor of the Exchequer George Osborne provides details of budget cut today in the review. His austerity measures aim to almost eliminate the GBP 156b deficit over four years to maintain the nation's top credit rating. Markets will be highly interested to see how far this austerity plan is implemented. On the other hand, markets will be interested to get from the BoE minutes how far BoE is to expanding the asset purchase program. BoE Governor King noted that some gauges of inflation in UK are "extremely subdued". CEBR said earlier this week that BoE will expand the asset purchase program by GBP 100b to help sustain recovery. | |

| Featured Technical Report | |

EUR/GBP Daily OutlookDaily Pivots: (S1) 0.8709; (P) 0.8767; (R1) 0.8795; More EUR/GBP is still bounded in sideway consolidations from 0.8838 and intraday bias remains neutral. While another fall cannot be ruled out as the consolidation continues, we'd expect strong support from 38.2% retracement of 0.8141 to 0.8838 at 0.8572 to contained downside and bring rally resumption. Above 0.8838 will target medium term falling trend line resistance (now at 0.8902) and above. |

| Forex Brokers | ||||||

|

| Special Reports |

BOC Leaves Interest Rates Unchanged, Revised Down Economic ForecastsAs expected, the BOC kept the overnight rate unchanged at 1% and revised lower growth forecasts for 2010 and 2011, saying 'the output gap is slightly larger and that the economy will return to full capacity by the end of 2012 rather than the beginning of that year'. Policymakers said that a weaker US outlook, moderate growth in emerging economies and slowdown in domestic economic outlook suggest further reduction in monetary policy stimulus would need to be 'carefully considered'. Canadian dollar tumbled after the announcement as the statement was more dovish than previously expected. |

| Economic Indicators Update | | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea: GBP/USD – Sell at 1.5805Despite falling to 1.5650 this morning, as the British pound has rebounded from there, suggesting a minor low has been formed and consolidation would take place with mild upside bias for retracement to the Kijun-Sen (now at 1.5769), break there would bring correction to 1.5795/00 (50% Fibonacci retracement of 1.5943 to 1.565) but reckon 1.5831-38 (61.8% Fibonacci retracement and previous support) would hold, bring another decline later. Trade Idea: EUR/USD – Sell at 1.3855Despite this morning's fall to 1.3697, the subsequent rebound from there suggests a minor low has been formed there and consolidation would take place with mild upside bias for retracement to 1.3828-30 (current level of the Kijun-Sen and previous support), however, reckon renewed selling interest would emerge around 1.3850/55 (50% Fibonacci retracement of 1.4006 to 1.3697) and bring another decline later Candlesticks Intraday Trade Ideas Update Schedule (GMT): Elliott Wave Daily Trade Ideas Update Schedule (GMT): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment