| Having trouble viewing this email? Click here |

|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

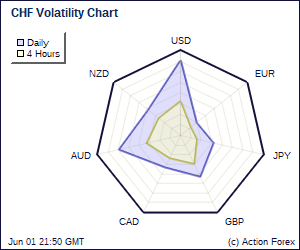

Mid-Day Report: Swiss Franc Soars on Safe Haven FlowsSwiss franc continues to ride on wave of risk aversion trade and strengthens across the board today. Its strength impressively surpasses yen and dollar. Some cites the strong UBS consumption indicator, which rose to two year high of 1.86 as a trigger for swissy's strength. But it's believed that safe-haven flow from other European countries are the main driving force. Euro hit another record low against swissy and is now sustaining below 1.3 level. Sterling also dives against swiss franc after taking out 1.58 support level. In addition to that, Hungary's forint also fell to a record low against the swiss franc. We'd anticipate more upside in CHF in near term. | |

| Featured Technical Report | |

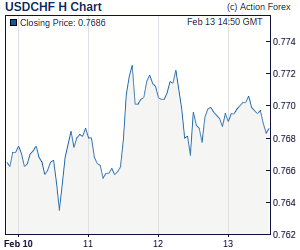

USD/CHF Mid-Day OutlookDaily Pivots: (S1) 1.0229; (P) 1.0269; (R1) 1.0300; More. USD/CHF's down trend resumes today and reaches as low as 1.0164 so far. Intraday bias remains on the downside and further decline should be seen to lower trend line support (now at 1.0040). But we'd anticipate strong support at around parity to contain downside, at least initially. On the upside, break of 1.0308 resistance will in turn argue that a short term bottom is formed and bring recovery towards 1.0624/39 resistance zone. |

| Forex Brokers | ||||||

|

| Special Reports |

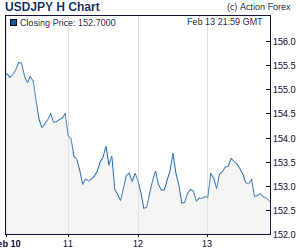

ECB To Extend Full Allotment Of Refinancing Operations Towards Year-EndAt Thursday's ECB, president Trichet is expected to leave the main-refinancing rate unchanged at 1% and reiterate the view that current interest rates are 'appropriate' while 'the risks to the economic outlook are broadly balanced in an environment of uncertainty'. Market's focus will be on the press conference where Trichet will announce the new set of staff macroeconomic projections and extend emergency support for the Eurozone until early 2011. BOJ Pledged 10 Trillion Yen For 6 Months To Stimulate RecoveryAt the emergency held today, the Bank of Japan announced additional easing measures to boost Japan's economic recovery. The BOJ introduced a 6-month term in the fixed-rate funds-supplying operation against pooled collateral and substantially increased the amount of funds to be provided through the operation. This is the first unconventional measures that the BOJ adopted in 5 months. |

| Economic Indicators Update | Attend The Futures & Forex Expo Las Vegas, September 23-25, at Caesars Palace, where industry experts will help Forex & Futures traders make profitable trading decisions. Register FREE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea Update: GBP/USD – Sell at 1.5470Although the British pound has fallen after brief recovery, loss of near term downward momentum should prevent sharp fall below 1.5330/35 (50% projection of 1.5910 to 1.5373 measuring from 1.5599) and reckon 1.5322 (38.2% Fibonacci retracement of 1.4228 to 1.5999) would limit downside, bring minor correction later. Trade Idea Update: USD/CHF – Stand asideCurrent cross-inspired selloff and the breach of 1.5442 support signals early rebound from 1.5373 (last week's low) has ended at 1.5599 and further weakness to 1.5389 is under way, break there would confirm early decline from 1.5999 has resumed and bring retest of 1.5373, then towards 1.5330/35 (50% projection of 1.5910 to 1.5373 measuring from 1.5599) but reckon 1.5322 (38.2% Fibonacci retracement of 1.4228 to 1.5999) would limit downside. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||