|

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

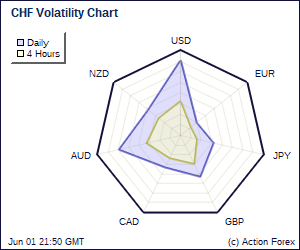

Daily Report: Dollar and Yen Consolidate as Markets StabilizedDollar and yen are mildly softer in general as markets consolidate. Both currency should have found a temporary top earlier as selloff in stocks stabilized. Asian equities were mixed and stayed in tight range. Crude oil remains soft at around 75 level but selling momentum diminished. In general, markets are waiting for fresh stimulus to trigger another move. Note that we'd favor more upside in dollar, yen and swissy against European majors and commodity currencies going forward. However, the outlook in USD/JPY and USD/CHF is a bit mixed for the moment and we cannot call for bottomed in these two pairs with high confidence yet. | |

| Featured Technical Report | |

AUD/USD Daily OutlookDaily Pivots: (S1) 0.8894; (P) 0.8944; (R1) 0.9031; More With 4 hours MACD staying above signal line, a temporary low should be in place at 0.8858 and intraday bias is turned neutral. Some consolidations would be seen in AUD/USD first. But upside is expected to be limited below 0.9220 resistance and bring another fall. Below 0.8858 will target lower channel support (now at 0.8670). Further break there will indicate that whole choppy rise from 0.8066 is finished too and deeper decline should be seen to retest this support level next. |

| Forex Brokers | ||||||

|

| Special Reports |

RBA Comfortable With RatesThe RBA's minutes for the August meeting reinforced our view that the policy rate will remain unchanged in the near-term. Policymakers stated that 'developments over the latest month had not materially changed the Board's assessment' and they were 'comfortable with the existing level of interest rates, particularly in an environment where there was a significant degree of market volatility. |

| Economic Indicators Update | Attend The Futures & Forex Expo Las Vegas, September 23-25, at Caesars Palace, where industry experts will help Forex & Futures traders make profitable trading decisions. Register FREE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea: GBP/USD – Buy at 1.5590Yesterday's anticipated rebound and the breach above Ichimoku cloud top add credence to our view that a temporary low has been formed at 1.5535 and consolidation with upside bias remains for test of 1.5703-14 resistance (this also include (38.2% Fibonacci retracement of 1.5999 to 1.5535), break would encourage for retracement of recent fall towards 1.5767 (61.8% Fibonacci retracement of 1.5910 to 1.5535) but previous support at 1.5710 would hold from here. Trade Idea: USD/JPY – Sell at 85.65Although the greenback has recovered after falling to 85.11 this morning and consolidation with initial upside bias is seen for retracement to the Kijun-Sen (now at 85.54), reckon 85.65-72 (current level of the Ichimoku cloud bottom and previous support) would attract renewed selling interest and bring another decline later. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment