|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

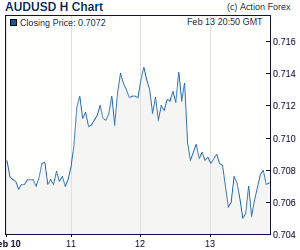

Daily Report: RBA on Hold as Expected, Aussie Mildly Lower on Weak DataRBA left interest rates unchanged at 4.5% for the third straight month today as widely expected. Governor Glenn Stevens noted in the statement that "with growth likely to be close to trend, inflation close to target and the global outlook remaining somewhat uncertain, the board judged this setting of monetary policy to be appropriate." Nevertheless, Aussie pare some of overnight's gain on weak data. Building approvals dropped for the third month by -3.3% mom in June while retail sales grew less than expected by 0.2% mom. The data added more evidence that RBA's six rate hikes between October and May are having an effect on the economy. It also solidify speculations that RBA would remain on hold, possibly throughout the year. Though, Aussie's trend will continue to be driven mainly by risk sentiments. | |

| Featured Technical Report | |

EUR/USD Daily OutlookDaily Pivots: (S1) 1.3090; (P) 1.3142 (R1) 1.3232; More. EUR/USD rises further to as high as 1.3194 so far after clearly taken out 1.31 cluster level. Intraday bias remains on the upside and current rally should now target 50% retracement of 1.5143 to 1.1875 at 1.3509 next. On the downside, below 1.3054 minor support will turn intraday bias neutral. But break of 1.2731 support is needed to indicate that EUR/USD has topped. Otherwise, outlook will remain bullish. |

| Forex Brokers | ||||||

|

| Special Reports |

RBA Left OCR Unchanged At 4.5%, Taking A Wait-And-See StanceThe RBA left the OCR unchanged at 4.5% for the 3rd consecutive month. Few surprises were seen in the accompanying statement. The overall tone was similar to that of July while the economic outlook was also unchanged. Policymakers acknowledged that global economic expansion, while faster than trend, has been uneven. There are signs that Chinese growth is 'moderating to a more sustainable rate as policies are now less accommodating'. Moreover, positive stress test results also diminished concerns over European banking systems and 'the caution evident in financial markets in the past few months has abated of late'. In July, the central bank explicitly mentioned that 'caution in financial markets has been evident in the past couple of months, driven principally by concerns about European sovereigns and banks but also by some uncertainty about the pace of future global growth'. Central Bank Previews: RBA, ECB, BOEDespite the positive stress test result and recent stronger-than-expected economic data the ECB should maintain its monetary stance and keep the main refinancing rate unchanged at 1%. President Trichet should reiterate in the meeting statement that the current key ECB interest rates are 'appropriate' and the 'risks to the economic outlook are broadly balanced, in an environment of high uncertainty'. |

| Economic Indicators Update | Attend The Futures & Forex Expo Las Vegas, September 23-25, at Caesars Palace, where industry experts will help Forex & Futures traders make profitable trading decisions. Register FREE | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea: EUR/USD – Buy at 1.3060Despite yesterday's rally to 1.3196, as the single currency has retreated after faltering below there this morning, suggesting consolidation would be seen and below the Kijun-Sen (now at 1.3126) would bring retracement to minor support at 1.3055/60, however, renewed buying interest should emerge there and bring another upmove later. Trade Idea: GBP/USD – Buy at 1.5800As the British pound has maintained a firm undertone, suggesting recent upmove remains in progress and further gain to 1.5920/30 and later towards 1.5970/75 (1.618 times projection of 1.4949 to 1.5473 measuring from 1.5125) is under way, however, near term overbought condition should limit upside to psychological resistance at 1.6000t and risk from there is seen for a minor correction later. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment