|

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

Daily Report: Euro Mildly Lower as Greece Concern Resurface, Yen Weakens on BoJ RumorMarkets are generally staying in familiar range with mixed price actions. Euro is softer as a German magazine pointed out that Greece's austerity measures are hurting the economy and raising social tension. The magazine pointed out that unemployment rate in Greece could rise to as high as 70% in some area while IMF projected over all unemployment of 12% this year. Yen is lower against dollar on rumors that BoJ would hold an emergency policy meeting for additional easing measures to boost recovery. Markets speculate that BoJ would either expand the fund supply by another JPY 10T to 30T, or extend the duration of fixed rate loans by three months to 6 months. Dollar manages to climb against major currencies but momentum is so far mild. | |

| Featured Technical Report | |

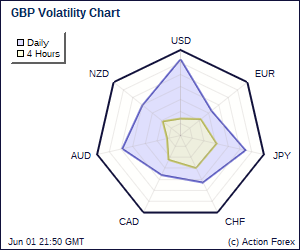

GBP/USD Daily OutlookDaily Pivots: (S1) 1.5497; (P) 1.5592; (R1) 1.5688; More. GBP/USD's post BoE minutes rebound was strong but brief. After all, it's limited below 1.5701 resistance and thus fall from 1.5997 is still in progress. Below 1.5497 will target 1.5123 cluster support (50% retracement of 1.4230 to 1.5997 at 1.5114). Also, note that the sustained trading below near term rising trend line suggests that whole rally from 1.4230 is completed too after failing 1.6 psychological level. Decisive break of 1.5123 will confirm this case and target a retest on 1.4230. On the upside, above 1.5701 will indicate that fall from 1.5997 is finished and bring recovery. But after all, risk will continue to remain on the downside as long as 1.5997 resistance holds. |

| Forex Brokers | ||||||

|

| Special Reports |

BOE Voted 8-1 To Leave Policy UnchangedAt BOE's minutes for the August meeting, committee members voted 8-1 to maintain the bank rate unchanged at 0.5% and the asset purchase program at 200B pound. Although inflation has overshot the central bank's upper threshold, it will drop below the 2% target in 2 years' time, thereby reducing the urgency to tighten monetary policies. Andrew Sentence, for a third time, voted against, preferring an increase in Bank Rate of +25 bps. |

| Economic Indicators Update | Attend The Futures & Forex Expo Las Vegas, September 23-25, at Caesars Palace, where industry experts will help Forex & Futures traders make profitable trading decisions. Register FREE | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea: USD/CHF – Sell at 1.0550Current break above the Ichimoku cloud top suggests near term upside risk has increased for retracement of the decline from 1.0630 and gain to 1.0523/25 (61.8% Fibonacci retracement of 1.0630 to 1.0350) is likely, however, reckon resistance at 1.0555 would attract renewed selling interest and bring another decline later. Only break of support at 1.0385 would signal the recovery from 1.0350 has ended and break of this level would confirm decline has resumed for retest of recent low at 1.0332, then towards 1.0288 (1.618 times projection of 1.0630 to 1.0465 measuring from 1.0555). Trade Idea: EUR/USD – Stand asideAlthough the single currency dropped below indicated support at 1.2805, lack of follow through selling and cross-buying against Japanese yen suggest further consolidation would take place but only break of the Ichimoku cloud top (now at 1.2852) would bring another leg of corrective rise to 1.2923-33 (previous resistance and 38.2% Fibonacci retracement of 1.3233 to 1.2734), break there would revive bullishness for retracement of recent decline to 1.2980/85 (50% Fibonacci retracement) but previous minor support at 1.3031 would hold. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment