|

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

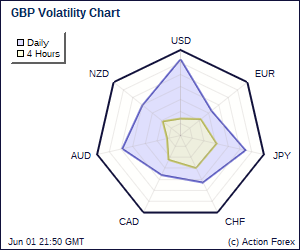

Mid-Day Report: Sterling Soars Post BoE Minutes, Canadian Dollar StrongSterling jumps sharply today as the BoE meeting minutes were not as dovish as markets expected. Andrew Sentence voted for an immediate 25bps hike for the third time in the August meeting. While the minutes mentioned that "he committee considered arguments in favor of a further easing" and "there were also arguments in favor of a small increase in bank rate." Overall, committee members voted 8-1 to maintain the bank rate unchanged at 0.5% and the asset purchase program at 200B pound. Although inflation has overshot the central bank's upper threshold, it will drop below the 2% target in 2 years' time, thereby reducing the urgency to tighten monetary policies. | |

| Featured Technical Report | |

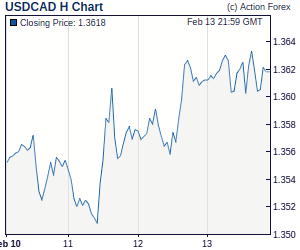

USD/CAD Mid-Day OutlookDaily Pivots: (S1) 1.0272; (P) 1.0355; (R1) 1.0401; More. USD/CAD's fall from 1.0493 extends further to as low as 1.0271 so far today. The break of 1.0296 support indicates that rebound from 1.0106 has completed at 1.0493 already, limited below the near term trend line resistance. Intraday bias is mildly on the downside for 1.0106. Nevertheless, note that after all, USD/CAD is staying in consolidation in converging range. Strong support should be seen around parity to contain downside. On the upside, above 1.0340 will turn intraday bias neutral again. |

| Forex Brokers | ||||||

|

| Special Reports |

BOE Voted 8-1 To Leave Policy UnchangedAt BOE's minutes for the August meeting, committee members voted 8-1 to maintain the bank rate unchanged at 0.5% and the asset purchase program at 200B pound. Although inflation has overshot the central bank's upper threshold, it will drop below the 2% target in 2 years' time, thereby reducing the urgency to tighten monetary policies. Andrew Sentence, for a third time, voted against, preferring an increase in Bank Rate of +25 bps. |

| Economic Indicators Update | Attend The Futures & Forex Expo Las Vegas, September 23-25, at Caesars Palace, where industry experts will help Forex & Futures traders make profitable trading decisions. Register FREE | ||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||

| Elliott Wave Daily Trade Ideas | |||||||||||||||||||||||||||||||||||

Trade Idea: AUD/USD – Buy at 0.8950Although the Australian dollar retreated after rising to 0.9080 yesterday and consolidation would take place, as low has been formed at 0.8858, downside should be limited to 0.8945/50 and bring another rebound. A firm breach of said resistance at 0.8980 would extend gain towards 0.9000, however, price should falter well below resistance at 0.9160/65 and bring further choppy trading below 0.9223 high. | |||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | |||||||||||||||||||||||||||||||||||

Trade Idea Update: GBP/USD – Buy at 1.5575Despite intra-day resumption of decline to 1.5498, the subsequent strong rebound from there after the release of BOE meeting minutes has justified our view that a temporary low should be seen soon and upside bias remains for test of 1.5703-14 resistance, however, break there is needed to retain bullishness for a stronger retracement to 1.5750/55 (61.8% Fibonacci retracement of 1.5910 to 1.5498) but reckon 1.5805/10 (61.8% Fibonacci retracement of 1.5999 to 1.5498) would hold. Trade Idea Update: EUR/USD – Buy at 1.2830Euro's intra-day rebound from 1.2824 retains our view that further consolidation would be seen and another corrective rise to 1.2917 is likely, above there would bring retracement of recent decline to 1.2925-33 (38.2% Fibonacci retracement of 1.3233 to 1.2734 and previous resistance) and possibly towards 1.2980/85 (50% Fibonacci retracement) but previous minor support at 1.3031 would hold. | |||||||||||||||||||||||||||||||||||

| Suggested Readings | |||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights

| |||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment