|

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

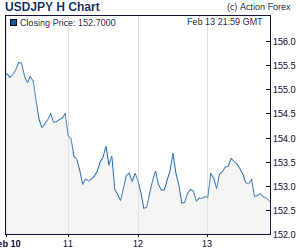

Daily Report: Yen Retreats as Intervention Talk Resurfaced, Euro Weak on Ireland DowngradeYen retreats mildly in Asia today as Prime Minister Kan and Finance Minister Noda met today while Noda also stepped up the rhetoric, pledging to take "appropriate action" on recent "one-sided" move in the currency. However, markets were again disappointed as nothing concrete was concluded after the meeting. Indeed Noda told reports that the meeting was mainly focused on economic analysis rather than specific address on yen's rise. Though, it's believed that BoJ, on the other hand, might be ready to implement additional measures to loosen monetary policy further to ease the negative impact of yen on the export-led economy, in particular if there proves to be sharp deterioration in business sentiment. | |

| Featured Technical Report | |

EUR/CHF Daily OutlookDaily Pivots: (S1) 1.2995; (P) 1.3087; (R1) 1.3133; More EUR/CHF's fall resumed after brief recovery and reached as low as 1.2986, meeting mentioned target of 1.3 psychological level. At this point, intraday bias remains on the downside as long as 1.3190 minor resistance holds. Sustained trading below 1.3 will target 100% projection of 1.4587 to 1.3072 from 1.3923 at 1.2408 next. On the upside, though, above 1.3190 minor resistance will argue that a short term bottom is possibly in place with bullish convergence condition in 4 hours MACD and on oversold condition. Stronger recovery should be seen towards 1.3455 resistance before staging another decline. |

| Forex Brokers | ||||||

|

| Special Reports |

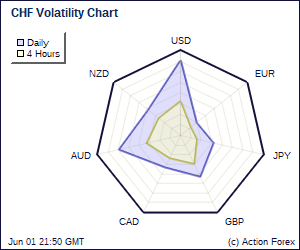

Swiss Franc to Outperform other 'Safe' CurrenciesA comeback of concerns about global economic slowdown has induced strong demand for safe-haven assets. While stocks, commodities and other growth assets got dumped, bond prices rallied, pushing yields to record lows, which currencies that are considered as 'safe' soared. While USD, JPY and CHF are traditionally considered shelters when risk aversion increases given the abundant liquidity and solid economic backdrop in the countries, we expect strength of Swiss franc to continue in the near-term as market confidence remains fragile. It should also outperform USD and JPY as Switzerland has relatively stable fundamentals than the US and Japan. |

| Economic Indicators Update | Attend The Futures & Forex Expo Las Vegas, September 23-25, at Caesars Palace, where industry experts will help Forex & Futures traders make profitable trading decisions. Register FREE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea: USD/CHF – Sell at 1.0380Despite intra-day brief fall to 1.0278, lack of follow through selling after breaking support at 1.0286 suggests consolidation would be seen and recovery to the Ichimoku cloud bottom (now at 1.0356 cannot be ruled out, however, renewed selling interest should emerge below the Ichimoku cloud top (now at 1.0389) and bring another decline later towards recent low at 1.0257, break there would extend decline towards 1.0200 which is likely to hold on first testing. Trade Idea: EUR/USD – Hold long entered at 1.2640Despite yesterday's rebound from1.2588 to 1.2720, failure to close above the Ichimoku cloud bottom and the subsequent retreat suggest caution on our long position entered at 1.2640 and intra-day minor support at 1.2616 must hold for prospect of another rebound later. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||

No comments:

Post a Comment